Interpreting the right time to buy and sell stocks

As I have said there is many variances and details that go into interpreting the right time to buy and sell stocks at a certain time. I have showed a few simple ways to help improve and understand the right time to buy and sell stocks. When looking at a stock or security you are interested in. I will include my top five keys below that I always like to check on before interpreting the right time to buy and sell stocks . This can differentiate depending on what type of trader you are. Moving average strategies are very popular and can be custom fit to any time frame, suiting both long term investors and short term investors. The (MA) or moving average is a simple technical analysis tool that many traders focus on heavily. The (MA) smooths out price and data by creating a constantly updated average price. This average is then taken over a unique period of time, like 5 days, 30 minutes, 30 weeks, but for you as a trader you can decide what to look at based on the type of trader you are.

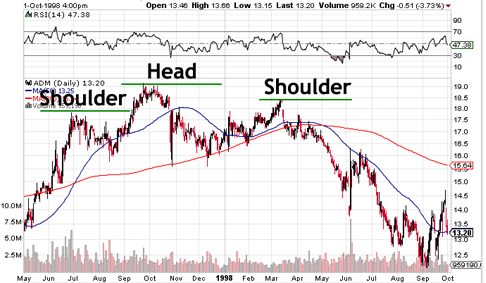

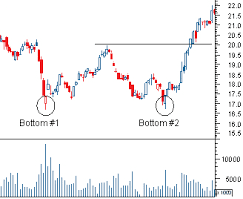

#1- Volatility as explained in my first post which I believe is one of the most important factors to get a good feel for where that stock is heading and how the majority of investors are interpreting the right time to buy and sell stocks due to resistance points. Please follow the link to learn more about volatility https://www.vebbit.com/blog/read-stock-charts/

#2- The next thing you will always want to take a look at is the (P/E) or price to earnings ratio as explained better in my previous post. Please follow this link on my previous post www.vebbit.com/blog/using-price-earnings-ratio-value-stock to learn more about the (P/E) ratio. You will always want to look at this and get as much information from the last earnings report. The reason I say that is because if you are looking at a growth stock you would definitely want to make sure they are growing at or faster then the pace they predicted for that earnings report. This is another very simple thing to look at just by looking up the stock ticker through finance.google.com They will have the (P/E) ratio already computed for you.

#3- Now that you have learned a few things and multiple signals of what stock or security you are looking to purchase. You now have a better idea of what to look for on charts. Please refer to previous links about the different charts I have explained to recognize the patterns and resistance points. Also, after you have looked into a certain stock there are many more variables then just these five keys.

#4- After you have dug into the first three keys and got a better idea of what that stock is doing. You will also want to take a look at the market as a whole. There is many things that can effect a certain group of stocks or securities. For example, lets just say you were looking at a stock in the gaming industry and they are coming out with earnings. Two gaming industry stocks (ATVI) or Activision Blizzard might miss on earnings and so other stocks that are in that sector might fall as well. An example of a few other gaming sector stocks could be (EA) or Electronic Arts, (TTWO) or Take-Two Interactions, (SNE) Sony. So if one or two miss earnings it can affect the whole sector for that day. Another reason you would want to take a look at the whole market is the different sectors that have been grouped together. The main sectors are shown below so if you were playing a Energy stock, Basic Materials, and Financials. You will want to be careful playing those certain sectors.

Sector summary

| Sector | Change | % down / up | |||||||

| Energy | -0.78% |

|

|

||||||

| Basic Materials | -1.45% |

|

|

||||||

| Industrials | -0.08% |

|

|

||||||

| Cyclical Cons. Goods … | -0.30% |

|

|

||||||

| Non-Cyclical Cons. Goods… | +0.22% |

|

|

||||||

| Financials | -1.20% |

|

|

||||||

| Healthcare | -0.35% |

|

|

||||||

| Technology | -0.02% |

|

|

||||||

| Telecommunications Servi… | -0.03% |

|

|

||||||

| Utilities | +0.10% |

|

|

||||||

#5- Now that I have discussed four of the main keys. Lets decide what type of trader you are short term, long term, or both. This is very important when pertaining to certain stocks or securities. Are you looking for a long investment that has a good dividend and stock buybacks. Or you could be looking to play a short options trade or earnings play. If you are going to play options I must emphasize that you watch the stock very closely. There are many things that can make stocks move big percentages in a very short time. Lets just say for example you were playing (VRTX) Vertex Pharmaceuticals Inc. at the beginning of this year. If you were not paying attention this could be a huge problem. Vertex was giving investors high hopes with a couple of drugs getting approved by the FDA. It also had some promising drugs that were in the works. So lets say you had bought some call options and were more than happy with the return you had seen starting the year. Well if you take a look at that company from January 6, 2016 to just one week later January 13, 2016 Vertex had dropped well over 30% which would mean your call options are probably now worthless.